This guide will help you select the appropriate health insurance plan for you and your family. For many people, an ACA Marketplace/exchange plan, commonly referred to as Obamacare, is a good option, and most enrollees qualify for financial assistance with the cost of their Ohio Marketplace coverage. 1

People in Ohio use HealthCare.gov to enroll in ACA Marketplace plans. The state operates a marketplace plan management exchange. This means that while the federal government manages the exchange, the state oversees and certifies qualified health plans (QHPs) for sale on the exchange .

For 2024, there are a dozen insurers offering coverage in Ohio’s exchange, including one new carrier. Plan availability varies from one area to another, but residents in nearly every county can select from at least three insurers’ plans for 2024. 2 All 12 carriers plan to continue to offer Marketplace coverage in Ohio in 2025, and another new carrier has filed plans for 2025 (see rate change details below).

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Ohio.

Learn about Ohio's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Ohio as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Ohio.

To qualify for health coverage through the Marketplace in Ohio, you must: 3

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your income and how it compares with the cost of the second-lowest-cost Silver plan in your area – which depends on your age and location. In addition, to qualify for financial assistance with your Marketplace plan you must:

In Ohio, y ou can sign up for an ACA-compliant individual or family health insurance between November 1 and January 15 during open enrollment . Your coverage starts on January 1 if you enroll by December 15. But if you apply between December 16 and January 15, your coverage will begin on February 1. 7

Outside of the annual open enrollment window, you may be eligible to enroll if you experience a qualifying life event , such as giving birth or losing other health coverage. (There’s also an extended special enrollment period for people who lose Medicaid or CHIP between March 31, 2023 and November 20, 2024. 8 )

Note that some people can enroll year-round even without a specific qualifying life event.

To enroll in a Marketplace plan in Ohio, you can:

You can find affordable health insurance options in Ohio through HealthCare.gov – the ACA Marketplace.

Under the Affordable Care Act, you may qualify for income-based subsidies , known as Advance Premium Tax Credits (APTC). These credits can reduce your premium and lower your overall costs.

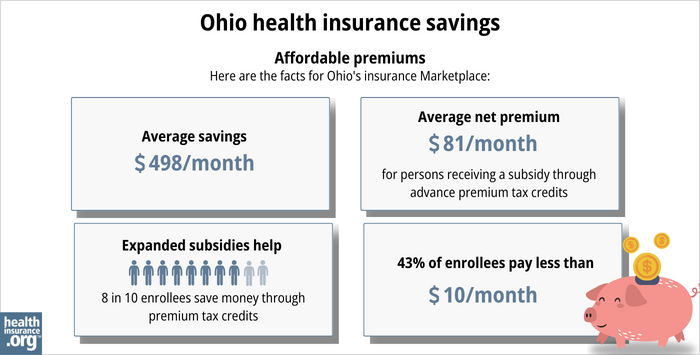

As of early 2024, nine out of ten Ohio Marketplace enrollees were receiving APTC. The subsidies averaged about $499/month, and the average net premium paid by enrollees was about $130/month. 10

(The numbers above are based on effectuated enrollment in early 2024. The chart below is a little different; it shows some different metrics, and uses data from all applications submitted during the open enrollment period for 2024 coverage.)

If your household income isn’t more than 250% of the federal poverty leve l, you may also be eligible for cost-sharing reductions (CSR). CSRs help lower your deductibles and out-of-pocket expenses. With APTCs and CSRs, an ACA plan may be a cost-effective health insurance option.

Low-cost health insurance is also available through Medicaid. Use our guide to see if you qualify for Medicaid in Ohio.

facts for Ohio’s insurance Marketplace: Average savings - $498/month. Average net premium - $81/month for a person receiving a subsidy through advance premium tax credits. Expanded subsidy help - 8 in 10 enrollees save money though premium tax credits. 43% of enrollees pay less than $10/month. " width="700" height="355" />

facts for Ohio’s insurance Marketplace: Average savings - $498/month. Average net premium - $81/month for a person receiving a subsidy through advance premium tax credits. Expanded subsidy help - 8 in 10 enrollees save money though premium tax credits. 43% of enrollees pay less than $10/month. " width="700" height="355" />

Thirteen insurers have filed rates and plans for 2025 Marketplace coverage in Ohio. 12 13

Twelve of those insurance companies offer Marketplace coverage in 2024, including Aetna Health Inc. which joined as a new addition in 2024. Plan availability varies from one area to another, but residents in nearly all areas of Ohio can choose from at least three insurers’ plans for 2024 coverage: 2

Ohio’s Marketplace insurers have proposed the following average rate increases for 2025, calculated before premium subsidies are applied: 14 (Proposed rates are under review by state regulators; rates will be finalized before open enrollment begins in November 2024.)

Source: Ohio Rate Review Submissions 14 and Ohio SERFF 13

The proposed rate changes apply to full-price premiums. Most Ohio exchange enrollees receive premium tax credits, so they don’t pay the full premium. 10 For those who qualify for subsidies, changes in plan rates and subsidy amounts determine their net rate change.

For perspective, here’s how average unsubsidized premiums have changed in Ohio over the years:

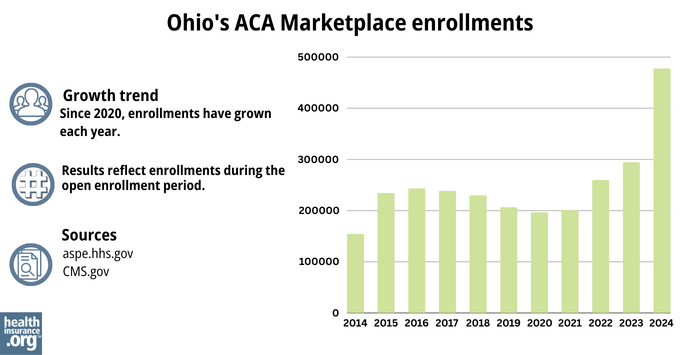

During the open enrollment period for 2024 coverage, 477,793 people enrolled in private health plans through Ohio’s Marketplace. 24

This was far higher than any other year; the previous record high had come in 2023, when 294,644 people enrolled through Ohio’s Marketplace during open enrollment. 25

The surge in enrollment in recent years is primarily due to the American Rescue Plan (ARP) making ACA’s premium subsidies more substantial. Under the ARP, subsidies are larger and more widely available. And this has been extended through the end of 2025 by the Inflation Reduction Act. 26

The 2024 enrollment growth was also partially due to the “unwinding” of the pandemic-era Medicaid continuous coverage rule. Medicaid disenrollments resumed in Ohio in the spring of 2023, after being paused for three years. By April 2024, more than 190,000 Ohio residents had transitioned from Medicaid to a Marketplace plan. 27

Source: 2014, 28 2015, 29 2016, 30 2017, 31 2018, 32 2019, 33 2020, 34 2021, 35 2022, 36 2023, 37 2024 38

Healthcare.gov : This is the federal website where you can enroll in a health insurance plan through the ACA Marketplace.

Ohio Medicaid : Eligible individuals and families can enroll in Medicaid, which provides low-cost or free health coverage. You can also enroll in Medicaid through Healthcare.gov or call (800) 318-2596.

Ohio Department of Insurance (ODI) : To receive assistance with insurance and Medicare, call an ODI representative at (800) 686-1526.

Ohio Department of Job and Family Services : You can get help if you’re struggling to afford health coverage or want to know more about Medicaid eligibility or benefits.

Ohio Senior Health Insurance Information Program (OSHIP) : OSHIP offers free health insurance information to people on Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.